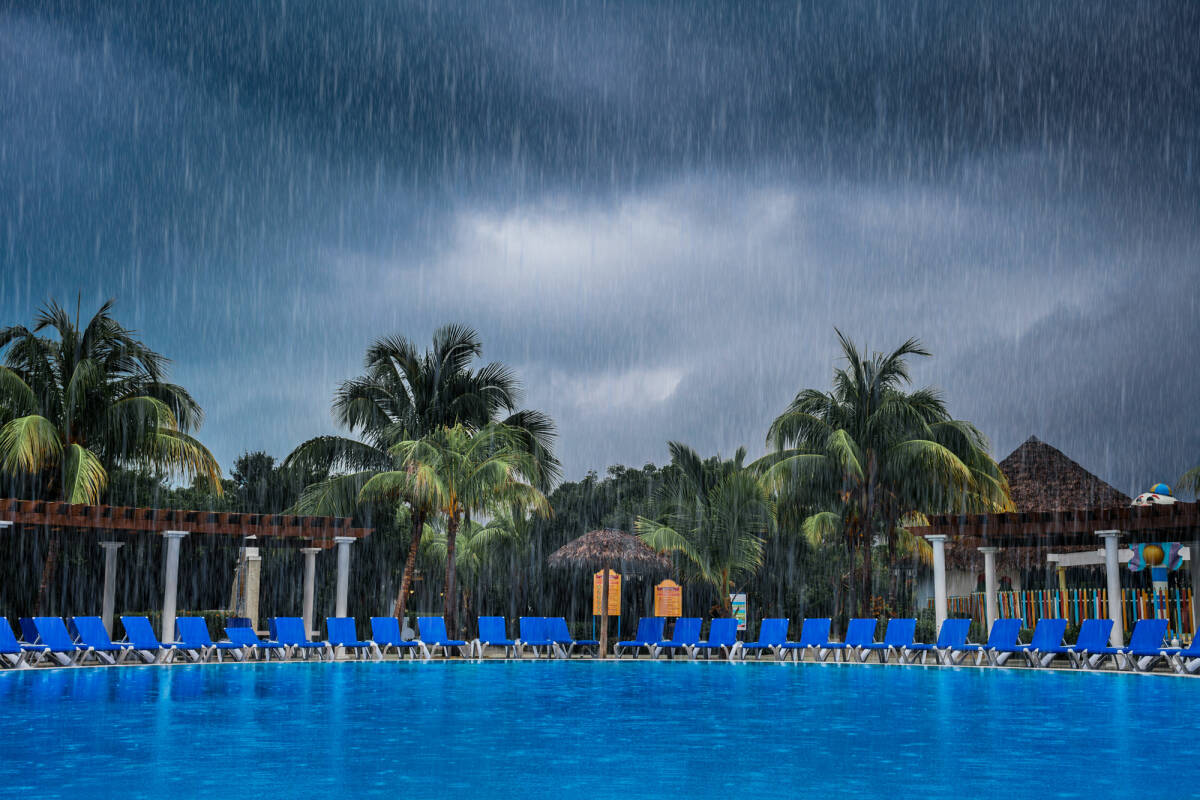

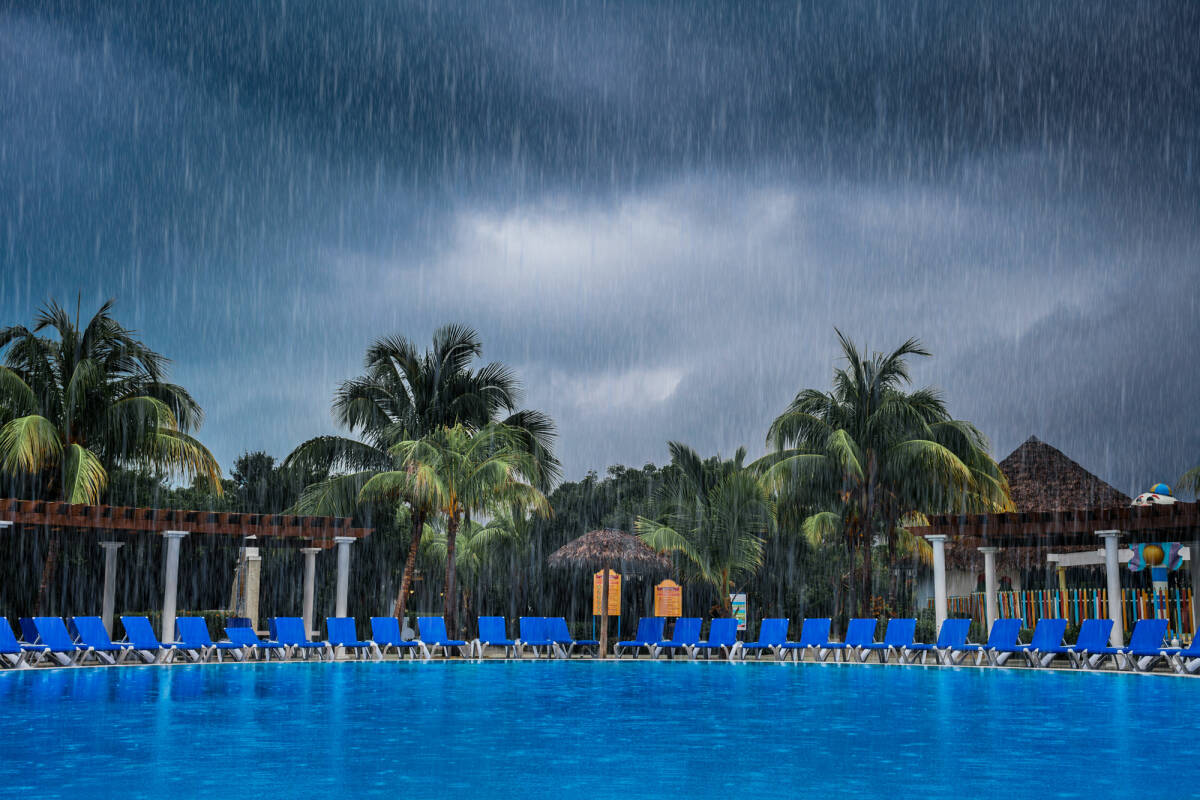

Why Should You Buy Travel Insurance for Weather Cancellations?

The venture of traveling may be thrilling, but it can also be unpredictable. It’s crucial to ensure that you’re prepared for any event that might occur during your trip due to unexpected weather patterns and sudden adverse conditions.

Buying trip insurance for weather cancellations is one of the finest methods to safeguard yourself as a traveler. With this insurance, you can relax knowing you won’t be stranded or out of cash even if Mother Nature derails your plans.

What Are Weather Cancellations?

Weather cancellations occur when bad or extreme weather forces you to cancel or delay your vacation. A few causes that could result in weather cancellations include storms, hurricanes, snowstorms, heat waves, and other severe weather patterns.

It’s crucial to comprehend how weather-related cancellations can affect your plans. It will assist you in ensuring that you have sufficient protection against any potential losses resulting from situations of this nature. Read up on what is covered in your policy before buying since not all travel insurance policies cover weather-related cancellations.

Types of Travel Insurance

Regarding travel insurance, several different policy types provide varying levels of protection. Generally speaking, most policies will fall into two categories: comprehensive and non-comprehensive.

Comprehensive policies cover a variety of different areas, including:

- Medical expenses

- Flight cancellations and delays

- Theft or loss of luggage and more

These policies tend to be the most expensive but offer the most robust coverage for travelers.

Non-comprehensive policies often omit certain coverage items like medical expenses, travel delays, or cancellations. They typically cost less than comprehensive plans but may not provide all the coverage needed for your specific situation.

Which Policies Cover Weather Cancellations?

A comprehensive policy that covers trip cancellations resulting from bad weather is the greatest option for weather-related cancellations. If your trip is postponed or canceled due to storms or other extreme weather, these policies might also cover accommodation and transportation costs.

What Weather Cancellations Are Covered

So, what types of weather cancellations are covered by travel insurance? Generally speaking, most policies cover delays and cancellations due to storms, hurricanes, blizzards, extreme heat waves, and other forms of severe weather.

However, it’s essential to check your specific policy for any limitations or exclusions, as some may not cover certain weather events.

When selecting a policy that covers weather cancellations, it’s also essential to look at the limits of coverage provided. For instance, some policies may pay out only if you’re delayed or canceled for more than 24 hours due to inclement weather.

You must consider all the potential hazards of your chosen travel destination that you can encounter to get the best severe weather cancellation travel insurance package. Knowing whether your policy covers weather-related cancellations can guarantee you enough protection in case of any unforeseen disruptions or delays caused by severe weather.

What Weather Cancellations Do Not Cover

Some weather-related cancellations are often not covered by travel insurance policies, such as those brought on by personal preferences or minor annoyances like a light rain shower. Furthermore, most insurance policies won’t cover you if you voluntarily change your travel plans the day before departure without an adequate reason (such as illness). This is because travel insurance products are made to shield you against unexpected circumstances that could otherwise prevent you from traveling. If you decide to cancel your trip for any other reason, the insurance will not pay out.

Selecting a policy that best fits your needs is essential for travelers seeking protection from unexpected disruptions caused by severe weather conditions. Look for policies with higher reimbursement limits and payouts in case of delays or cancellations due to inclement weather, and ensure you understand any limitations or exclusions before purchase.

What to Do if Weather Cancels Your Trip

There are a few things you should do if bad weather forces you to postpone your vacation. Find out if the existing travel reservation offers cancellation and refund policies first by contacting them. Ensure you receive any refunds or other forms of compensation in writing so that you have documentation if needed.

Contact your provider to submit a claim for the canceled trip if you have travel insurance. Study your policy documentation or contact your insurer for more information, as the claims process will differ based on the policy and provider. You may need to present cancellation documentation and trip-related spending receipts.

Once your claim is processed, you should receive reimbursement for the amount covered by your policy. Be aware that there may be certain limits and exclusions to what your policy covers.

To avoid future weather cancellations, it’s essential to read up on current weather conditions before booking your trip and consider purchasing a comprehensive travel insurance policy with coverage for inclement weather. Additionally, choose flights or tours that offer flexible cancellation policies in case of emergencies.

Additional Travel Insurance Coverage

Travel insurance policies can provide additional coverage beyond weather cancellations, which can help enhance your overall protection while traveling. Additional coverage includes trip cancellation/interruption, medical emergency, and COVID coverage insurance.

For instance, if you purchase a package vacation that includes flights and the tour is canceled due to bad weather, a comprehensive travel policy will cover the non-refundable components of the trip. Additionally, policies often include coverage for medical expenses if you become ill or injured during your travels, as well as reimbursement for any necessary medical evacuation costs that may arise.

Another great benefit of travel insurance is that it can cover lost or delayed baggage, especially if your trip involves multiple stops. Finally, flight accident policies can provide financial protection in the event of an unexpected accident while traveling.

Be Prepared for Weather Cancellations With Aegis General Travel Insurance

Weather-related travel disruptions can be highly inconvenient and costly. To ensure you’re financially protected in case of a disruption due to inclement weather, consider purchasing a comprehensive travel insurance policy that includes coverage for storms, hurricanes, winter weather, and other types of severe weather.

No matter where you intend to travel, Aegis offers excellent policies with the most comprehensive coverage for weather cancellations and other travel-related disturbances.

Check out our Go Ready VIP plan today to get the best coverage for your next trip!