Travel Insurance Coverage for Earthquakes

Are you about to embark on a trip and wondering if your destination is prone to natural

disasters like earthquakes? If so, travel insurance with the proper protection can be

essential when planning trips to earthquake-prone areas.

We will try to answer questions like “can travel insurance cover earthquakes?” and “what

types of expenses are covered under earthquake travel insurance?” We’ll also discuss

what to look for, how to prepare and protect yourself against earthquakes while traveling,

and what to do in an emergency.

Understanding Earthquake Risks During Travel

Earthquakes can cause terrible damage to people, properties, and infrastructure.

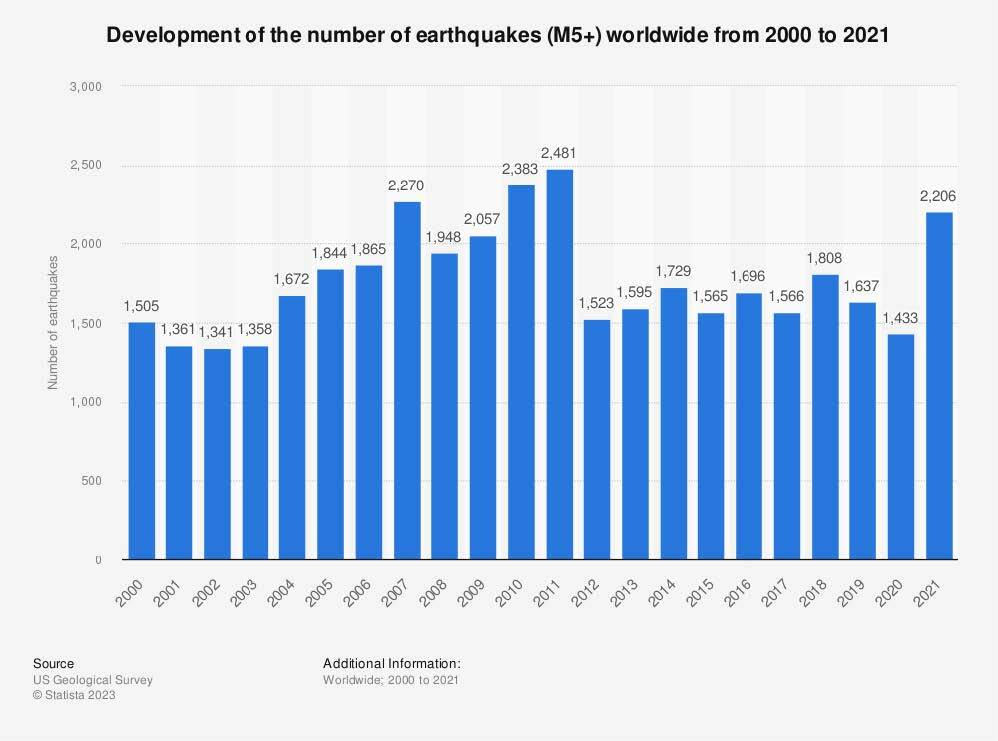

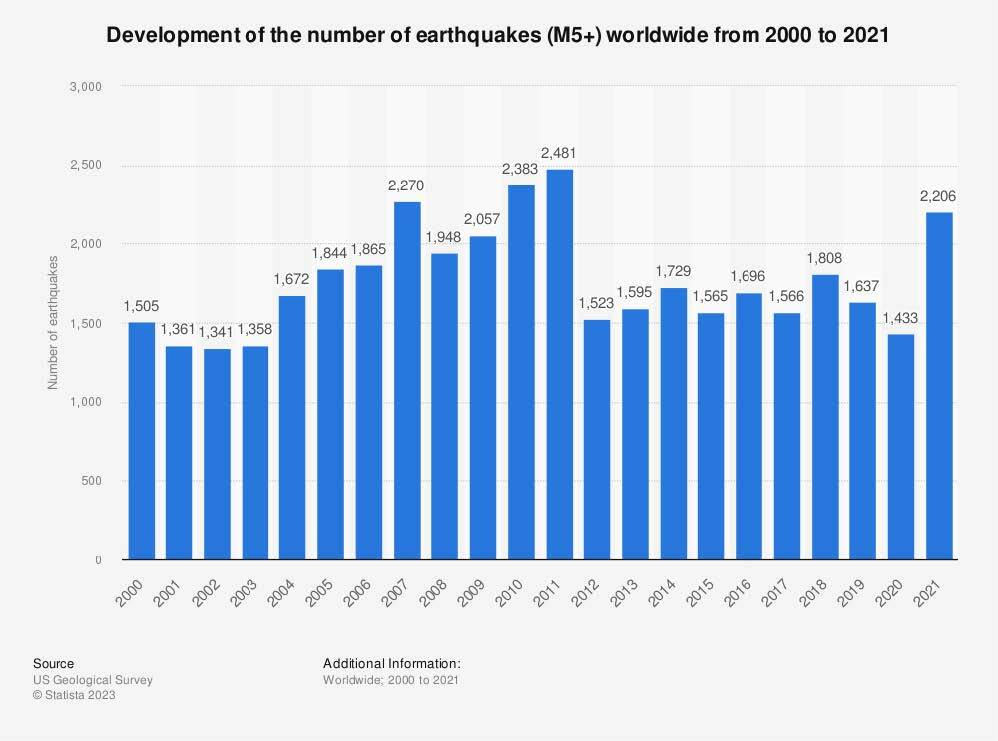

According to the National Earthquake Information Center (NEIC), an estimated 12,000 to 14,000 earthquakes happen yearly. In 2021 alone, there were more than 2,206

destructive earthquakes worldwide.

Earthquakes are also hazardous for travelers since they occur without warning. They

affect domestic and international travelers alike, as some of the most popular tourist

destinations are particularly prone to them.

For example, Japan is one of the most earthquake-prone countries in the world and is

visited by millions of tourists annually. It experiences hundreds of moderate-to-strong

earthquakes yearly that can cause considerable disruption for visitors. Similarly, other

popular tourist destinations like Mexico, Italy, Greece, and India all experience regular

earthquakes.

Given the dangers of earthquakes, it’s essential to consider earthquake coverage when

purchasing travel insurance. Many basic policies do not cover earthquakes, so it is crucial

to check your individual policy’s terms and conditions to make sure that you are

adequately covered in the event of an earthquake while you’re away from home.

Key Elements of Travel Insurance Coverage for Earthquakes

Travel insurance policies with earthquake coverage usually cover trip cancellation,

interruption, and delay due to earthquakes. Trip cancellation covers the cost of a prepaid,

non-refundable trip if it has to be canceled due to an earthquake that occurs before or

during your journey. Trip interruption covers additional expenses incurred if you must

interrupt your trip due to an earthquake.

This could include extra accommodation costs, meals, transport, etc. Trip delay coverage

reimburses reasonable additional expenses incurred due to a delayed departure caused by

an earthquake or other natural disaster.

In addition, travel insurance policies with earthquake coverage typically provide

emergency medical expense reimbursement for injuries resulting from an earthquake

during your trip. This includes medical evacuation if you need urgent medical treatment in

another country.

It’s important to remember that travel insurance policies with earthquake coverage

generally have certain restrictions and exclusions. For example, some policies exclude

earthquakes related to volcanoes or tsunamis, while others may only cover medically

necessary evacuation expenses. So it’s essential to read your policy details carefully

before purchasing it.

Preparing for an Earthquake While Traveling

When traveling to earthquake-prone areas, it’s important to be aware of the potential

risks and take the necessary precautions. Ensure you stay informed about recent

earthquakes in your destination by checking local news outlets or websites such as

Earthquake Track or USGS Earthquake Hazard Program. It’s also a good idea to create an

emergency plan with your travel companions, including contacting family members if

needed and having access to emergency assistance through your travel insurance

provider.

Before an earthquake, familiarize yourself with the safety procedures for different types

of buildings (hotels, public transportation, etc.) and practice what to do if an earthquake

occurs when you’re out and about. When indoors, find safe spots like door frames or

sturdy furniture you can cover under if the ground shakes. When outdoors, move away

from buildings, power lines, and trees and stay in an open area.

During an earthquake, it’s necessary to remain calm and protect your head and neck by

crouching, staying low to the ground, and covering yourself with a cushion or other object.

Avoid tall structures like bridges, overpasses, and power poles, which could collapse

during earthquakes.

After an earthquake has passed, check for injuries among your travel companions and

monitor local media outlets for further information about potential damage or safety

alerts. It’s also essential to keep all receipts related to any additional expenses incurred

due to the earthquake, as these could be reimbursed through your travel insurance policy.

Real-Life Examples of Earthquakes During Vacation

Every year, thousands of travelers experience earthquakes during their trips. Real-life

examples include an earthquake in Turkey on Feb 6, 2023 that affected tourists visiting

the popular Mediterranean destination. Many travelers had their vacations cut short and

faced delays due to disruptions caused by the earthquake. Similarly, two earthquakes

occurred off the coast of Majorca on Feb 23, 2023, which caused considerable disruption

for British tourists, prompting safety warnings from authorities.

In both cases, travel insurance could have assisted travelers affected by the earthquakes.

Travelers with comprehensive policies would likely have been eligible for trip cancellation

and interruption coverage, emergency medical expense reimbursement, and evacuation

services if necessary. Some policies may also protect against theft or damage caused by an

earthquake during the trip.

Aegis Travel Insurance Coverage for Earthquakes

Earthquakes can cause considerable disruption to travelers, and if you’re traveling to

earthquake-prone regions, it’s crucial to consider getting travel insurance that includes

earthquake coverage.

Aegis offers comprehensive travel insurance policies with robust earthquake coverage, so

you can rest assured that you will be protected during an unexpected natural disaster

while on vacation. Visit our Go Ready Travel Plans by Aegis page to find the best plan for

your trip.